How Military Tensions Are Driving the Next Semiconductor Chip Race

More from the Category

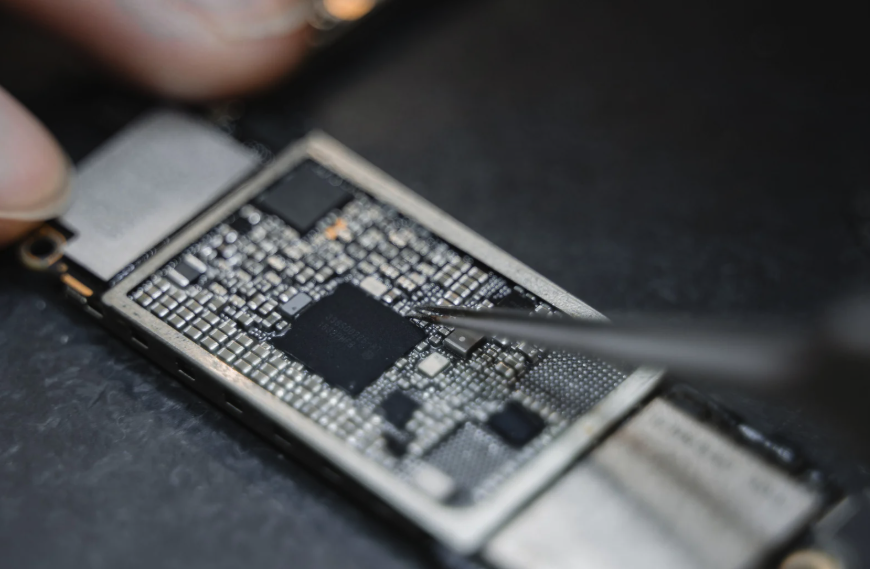

War has always been shaped by technology. In the 20th century, it was steel, oil, and nuclear fission. Today’s battlefields are defined by something far smaller yet infinitely more critical: the semiconductor chip.

Modern militaries don’t just need weapons, they need compute. Drones rely on AI for targeting. Hypersonic missiles demand real-time trajectory adjustments. Secure communications require unbreakable encryption. None of this happens without advanced silicon.

But here’s the twist. Unlike tanks or jets, chips aren’t built in isolation. They depend on a fragile, hyper-globalized supply chain, one that’s now cracking under the weight of military tensions. The U.S. and China are pouring billions into domestic production, not just for economic dominance, but because control over chips means control over defense readiness.

Taiwan, home to the world’s most advanced fabs, sits at the center of this storm. A single geopolitical shock could disrupt everything from consumer electronics to missile systems. The stakes couldn’t be higher.

This isn’t just about faster processors or cheaper consumer gadgets. It’s a race for sovereignty, security, and survival. And for engineers, that changes everything.

The Military’s Insatiable Demand for Advanced Chips

A fighter jet today isn’t just a flying machine, it’s a data center with wings. Consider the F-35: each aircraft contains over 8 million lines of code, processing sensor data from radar, infrared, and electronic warfare systems in real time. None of this would be possible without cutting-edge semiconductors.

The requirements are extreme. Military-grade chips must operate in conditions that would cripple consumer hardware: extreme temperatures, intense vibration, and even radiation exposure in space applications. A single failure could mean a missile missing its target or a drone losing its link.

This demand has reshaped priorities. While commercial chipmakers chase smaller transistors and higher clock speeds, defense contractors focus on reliability and security. Specialized foundries produce radiation-hardened processors, often using older but more robust node technologies. The Pentagon has even begun stockpiling legacy chips — because a 28nm processor you can trust is more valuable than a 5nm chip you can’t.

The numbers tell the story. The U.S. Department of Defense now spends over $2 billion annually on microelectronics, with funding growing 20% year-over-year. China’s military-civil fusion strategy pours even more into domestic semiconductor development.

For engineers, the implications are clear: the chips that matter most aren’t always the fastest or most efficient. They’re the ones that work when it counts.

Taiwan’s Dominance, And Why It’s a Ticking Time Bomb

A single island produces 92% of the world’s most advanced semiconductors. Taiwan Semiconductor Manufacturing Company (TSMC) didn’t just win the chip race, it basically built the track. Their 3nm and 5nm nodes power everything from smartphones to stealth fighters. But this concentration of capability has turned Taiwan into the world’s most critical geopolitical flashpoint.

For the U.S. military, the math is scary. If China blockades or invades Taiwan, the global tech economy would collapse overnight. More crucially, modern militaries would face an immediate semiconductor drought. The U.S. Air Force estimates 90% of its precision-guided munitions rely on TSMC chips. Warships, satellites, and communication systems would face similar vulnerabilities.

This explains the desperate scramble for alternatives. The U.S. is spending billions to jumpstart domestic production through the CHIPS Act, while Europe and Japan pour money into their own fabs. But rebuilding decades of TSMC’s process expertise isn’t just expensive, it may be impossible in the short term. Even Intel, with all its resources, trails TSMC by years when it comes to advanced nodes.

This is causing the strategic calculus to shift. Military planners now treat semiconductor supply chains with the same urgency as oil reserves. For engineers, the message is clear: geographic diversity in chip production is becoming a matter of national security. The era of assuming Taiwan’s fabs will always be available is over.

The Tech Cold War: Export Controls as Weapons

Semiconductors have become the new battleground in global power struggles, not with missiles, but with export licenses and equipment bans. The rules of engagement have changed: today, a customs form can be as strategically decisive as a naval blockade.

The U.S. fired one of the first shots in this silent war by blocking ASML from selling its extreme ultraviolet (EUV) lithography machines to China. These $200 million systems are the only way to produce chips at 5nm and below. Without them, China’s semiconductor ambitions hit an artificial ceiling. The message was clear: you can’t build next-generation weapons without next-generation chips.

China responded with brute-force investment. SMIC, its largest foundry, managed to produce 7nm chips using older deep ultraviolet (DUV) machines—a technical workaround that surprised analysts. Huawei recently unveiled a smartphone with an advanced domestic 5G chip, proving that sanctions can be outmaneuvered, at least temporarily.

But the ripple effects are complex. Every restriction forces adaptation. Russian military equipment, for example, has been found using dishwasher chips and repurposed automotive semiconductors after sanctions cut off traditional supply chains.

For engineers, this creates a paradox: the same globalized ecosystem that enabled decades of innovation is now fracturing into competing blocs. Designing a chip in 2024 means asking not just "can we build it?" but "who will let us build it?" — and that question may define the next decade of technological progress.

Innovation Under Pressure

War accelerates technology. The atomic bomb took six years to develop; the Apollo program reached the moon in eight. Today, semiconductor innovation is undergoing a similar forced march — not just for profit, but for survival.

Two approaches are emerging as critical in this high-stakes environment:

Chiplet Architectures – The U.S. and its allies are betting on modular designs that can mix and match components from different foundries. DARPA’s CHIPS program (Common Heterogeneous Integration and IP Reuse Strategies) aims to let militaries assemble processors like Lego blocks — so combining a radiation-hardened control chip from Texas with an AI accelerator from Taiwan, for example, is possible with this technology.

RISC-V Rebellion – China is pouring billions into this open-source instruction set architecture, seeing it as an end-run around Western-controlled ARM and x86 architectures. A military drone running on RISC-V can’t be cut off by export bans because the blueprint is freely available.

The irony is thick. The same global tensions choking supply chains are also sparking creativity. When TSMC can’t ship to Huawei, SMIC learns to improvise. When ASML can’t sell to China, researchers explore nanoimprint lithography. Necessity isn’t just the mother of invention, it’s the mother of redundancy, with nations building duplicate supply chains “just in case.”

For engineers, this means more than technical challenges. It’s a philosophical shift: from optimizing for performance at all costs, to designing for resilience above all else. The next generation of chips won’t just be measured in gigahertz, but in geopolitical immunity.

What Engineers Should Watch

The semiconductor industry no longer operates purely on Moore’s Law, it’s now equally governed by the laws of geopolitics. For engineers building the next generation of electronics, three critical trends demand attention:

Dual-Use Dilemmas

Commercial chips increasingly power military systems, blurring ethical lines. An NVIDIA GPU might train AI models for hospitals one day and simulate nuclear explosions the next. Engineers must now consider how their designs could be repurposed, whether they intend it or not. The same open-source AI tools used for agricultural drones can optimize missile trajectories.

Material Revolutions

Silicon’s dominance is being challenged where it matters most:

- • Gallium nitride (GaN) enables radar systems that see farther while using less power

- • Silicon photonics allows unhackable quantum communications between submarines

- • 2D materials like graphene could lead to chips that self-repair from radiation damage

The Neutrality Myth

The fantasy of "apolitical tech" is dead. Choosing a chip architecture (x86 vs. ARM vs. RISC-V) or fab location (Taiwan vs. Arizona vs. Shanghai) is now a geopolitical statement. Even open-source tools like RISC-V carry baggage — while designed in Berkeley, the technology's greatest user base is now in China.

The smartest engineers aren’t just reading IEEE journals anymore, they’re watching UN sanctions lists and trade policy updates, too. Because in today’s market, a supply chain disruption can derail a project faster than any technical bug. The question isn’t whether politics will affect your work. It’s whether you’ll see the changes coming in time to adapt.

Chips as the New Oil

History repeats itself, but with different resources at stake. In the 20th century, nations fought over oil fields and pipelines. Today, the battleground is semiconductor fabs and intellectual property. Control over advanced chip production has become as strategically vital as control over energy reserves, except silicon is harder to replace than crude.

The parallels are striking. Like oil in the 1970s, semiconductors are:

- • Concentrated in volatile regions (60% of advanced chips come from Taiwan)

- • Subject to cartel-like control (ASML’s EUV monopoly)

- • Sparking proxy conflicts (U.S.-China trade wars over SMIC)

But there’s a key difference: while oil fueled machines, chips fuel intelligence, both artificial and military. A country without oil might have a weaker economy, but a country without chips will have dumber missiles, blinder satellites, and more vulnerable infrastructure.

For engineers, this presents both a burden and an opportunity. The burden? Every technical decision now carries geopolitical weight. The opportunity? Your work matters more than ever — not just for profit margins, but for national security and global stability.

The next decade won’t be won by the country with the most soldiers, but by the one with the most resilient semiconductor ecosystem. And that ecosystem depends on engineers who understand that in the 21st century, the most important battlefields are measured in nanometers.

The question isn’t whether you’ll be involved in this race. You already are. The only choice is whether to run it blindfolded, or with your eyes wide open. And no matter what sort of military or defense system you’re working on, Microchip USA is the perfect partner for sourcing the components you need. Our team of industry veterans understands the modern supply chain, and we specialize in sourcing even the most hard-to-find parts, from CPLDs to SoCs. Contact us today!