Gallium Market Growth and Semiconductors

More from the Category

Gallium’s Rise to Strategic Importance

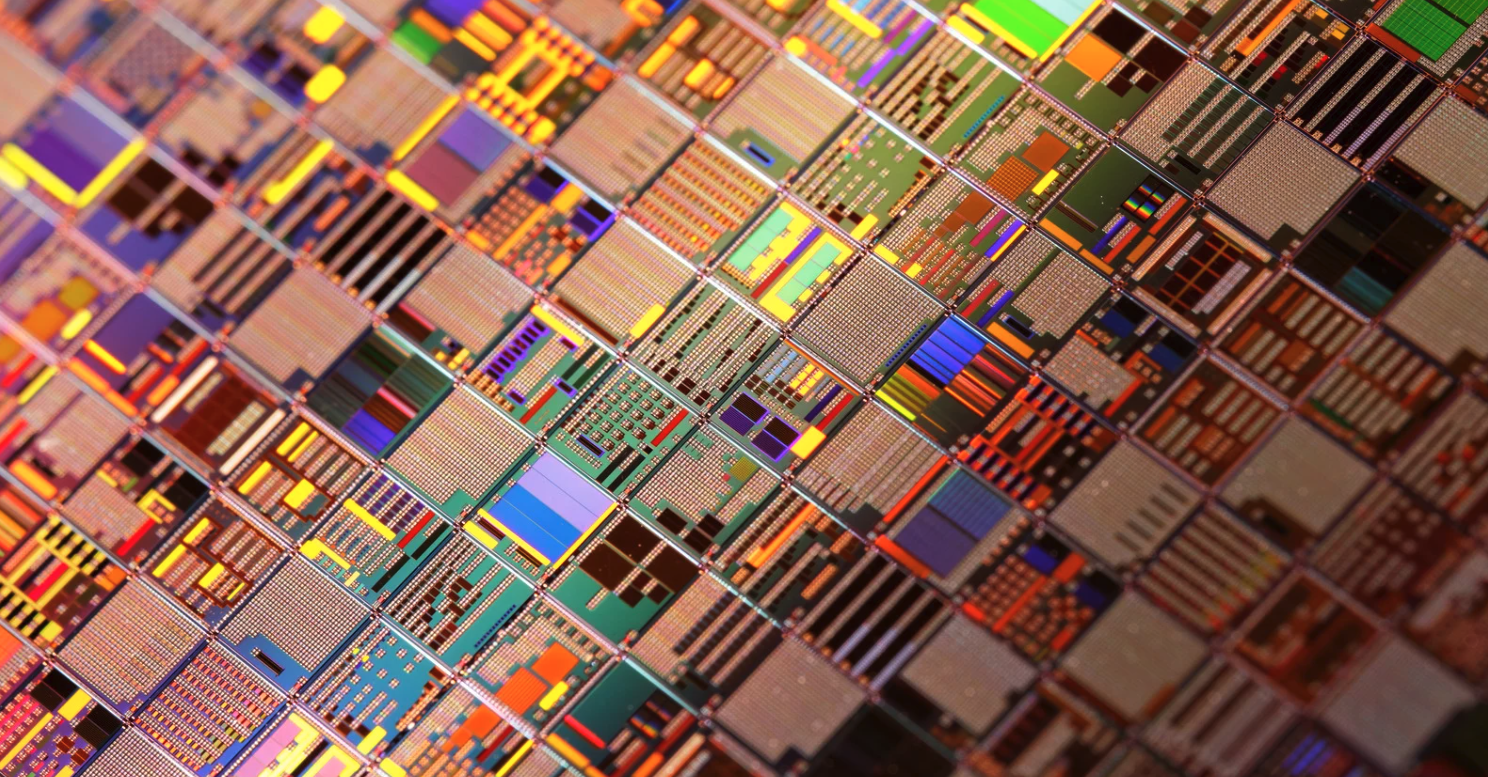

Once an obscure by-product of aluminum and zinc refining, gallium has rapidly become one of the most strategic materials in global technology. Its transformation reflects the growing demand for advanced gallium nitride semiconductors (GaN) and gallium arsenide (GaAs) devices that power everything from electric vehicles (EVs) to 5G networks.

This rise has created a dual narrative: while gallium’s importance in next-generation electronics continues to soar, the supply chain remains constrained by production bottlenecks and geopolitical risks.

Why Gallium Matters in Next-Gen Electronics

Gallium’s significance stems from its use in compound semiconductors - materials that outperform traditional silicon in speed, power efficiency, and thermal stability.

Gallium Nitride (GaN) semiconductors are redefining the landscape for power electronics, enabling faster switching speeds, higher voltages, and better energy efficiency. These properties make GaN devices essential for EV powertrains, renewable energy systems, and data centers.

Gallium Arsenide (GaAs), on the other hand, is indispensable in RF communications, satellite systems, and optoelectronics due to its high-frequency and high-efficiency characteristics.

Compared to silicon, which is reaching its physical limits in thermal and voltage performance, gallium-based semiconductors open the door to a new era of miniaturization and energy efficiency.

Market Growth: From Billions to Tens of Billions

The global gallium market is on track to expand from $ 2.45 billion in 2024 to over $ 21.53 billion by 2034, representing an impressive 24% CAGR.

This growth is being driven by several key sectors:

· Telecommunications: The backbone of 5G and emerging 6G infrastructure.

· Automotive: High-efficiency GaN power devices for EV charging and battery management.

· Renewable Energy: Solar inverters and smart grid applications.

· Aerospace and Defense: High-power radar and satellite communication systems.

Among these, power semiconductors are projected to be the fastest-growing segment, with GaN leading the charge.

China’s Dominance and Global Supply Risks

Currently, 98% of the world’s primary supply of gallium originates from China, giving it a dominant position in gallium production for semiconductor applications. This dominance poses serious supply chain risks. Recent export restrictions from China on gallium and germanium have already shaken the global semiconductor market, highlighting the fragility of dependency on a single source.

Learn More: China’s Export Ban on Critical Minerals to the U.S. Implications for the Electronics Industry

In response:

· The United States is exploring new gallium extraction initiatives, including discoveries in Montana.

· The European Union and Japan are accelerating diversification efforts and stockpiling critical materials.

These developments underscore the need for a balanced global supply chain, especially as gallium becomes integral to semiconductor manufacturing and the future of China's gallium production for semiconductors.

Learn More: It’s Time for the China Plus U.S. (Microchip USA) Strategy

Supply Challenges: Extraction and Recycling Limits

Gallium’s availability remains inherently constrained. It is not mined directly but extracted as a by-product of aluminum and zinc refining - a process that limits scalability.

While recycling gallium from semiconductor scrap and LEDs is technically feasible, it is still economically unviable on a large scale due to high recovery costs and low yield rates. As a result, price volatility and supply instability continue to be major concerns for manufacturers and distributors alike.

Technology Drivers Behind the Boom

The rapid growth of the gallium market is closely tied to innovations across multiple industries:

5G/6G Communications: GaAs enables high-frequency, low-loss systems critical to next-gen wireless infrastructure.

EVs and Renewables: GaN technology delivers superior power conversion efficiency, improving performance in chargers and inverters.

Data Centers & AI Infrastructure: High-density GaN power modules support efficient power delivery in energy-intensive computing environments.

Defense & Aerospace: GaN’s resilience and efficiency make it ideal for radar systems, satellite communications, and directed-energy applications.

These applications demonstrate how gallium nitride semiconductors are becoming foundational to the technologies shaping the digital and energy transitions.

Forecasts vs. Reality

While market forecasts project exponential growth, real-world adoption depends on practical integration into semiconductor ecosystems. Academic and industry models suggest that growth will align more closely with semiconductor adoption rates than with raw gallium prices.

Gallium’s long-term trajectory will hinge not only on demand forecasts but also on how efficiently GaN and GaAs devices can replace silicon in mainstream electronics.

Empowering the Next Generation of Gallium Based Technologies

Gallium’s role in next-generation electronics is undeniable. As the world transitions toward energy-efficient, high-speed systems, Microchip USA remains committed to ensuring that our partners and customers have reliable access to the components that will define the future of technology. Contact us today!