Country of Origin Data for Supply Chain Resilience: A Strategic Imperative

More from the Category

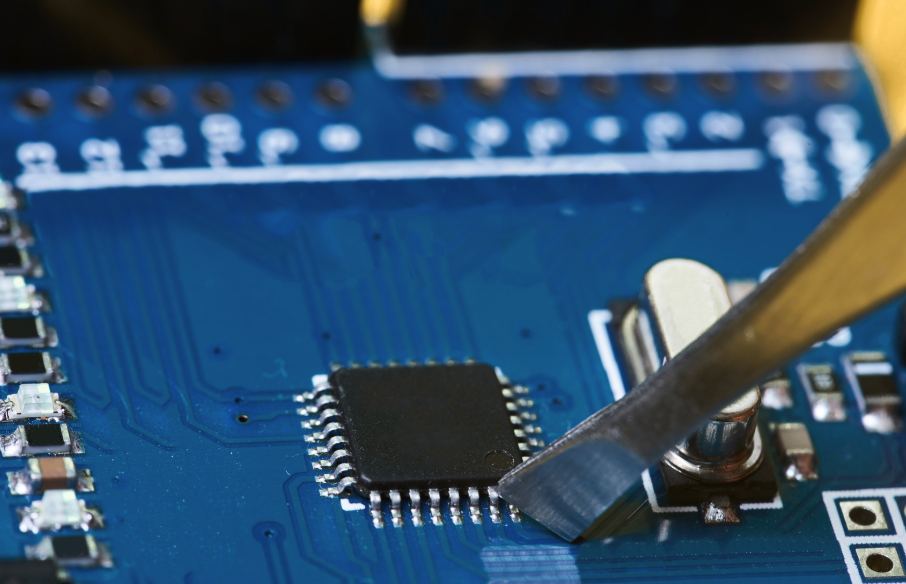

The electronics supply chain is a fragile beast. Geopolitical tensions, trade wars, and sudden disruptions (like pandemics or natural disasters) have exposed just how vulnerable global manufacturing networks can be. One of the most underutilized yet powerful tools for mitigating these risks? Country of Origin (CoO) data.

Understanding where components come from isn’t just about compliance — it’s about resilience, risk mitigation, and strategic sourcing. In this article, we’ll explore how CoO data strengthens supply chains, why engineers should care, and how companies are leveraging it to stay ahead of disruptions.

Why Country of Origin Data Matters More Than Ever

The global electronics supply chain is a marvel of modern engineering — until it breaks.

A single missing component can halt production for months. A sudden trade restriction can turn a reliable supplier into a liability. And a natural disaster halfway across the world can send shockwaves through your procurement cycle.

This fragility isn’t theoretical. The chip shortage of 2021-2023 proved how vulnerable supply chains are to disruption. But while most companies scrambled to secure inventory, the savviest engineers had already mitigated risk by leveraging Country of Origin (CoO) data.

The Blind Spot in Modern Procurement

Most electronics manufacturers track part numbers, lead times, and compliance status. Few track where their components actually come from—not just the final assembler, but the origin of raw materials, fabrication, and testing.

This is a critical oversight. Consider:

● Geopolitical risk: A capacitor sourced from Taiwan may be high-quality, but what if China invades?

● Trade wars: The U.S.-China tariffs added 25% costs overnight for some components. Did your BOM account for that?

● Compliance traps: ITAR and EAR regulations ban certain exports outright, and accidentally using a sanctioned supplier could mean fines or seized shipments.

The Resilience Advantage

Supply chain disruptions aren't hypothetical scenarios—they're inevitable events. The difference between companies that weather these storms and those that don't often comes down to one critical capability: visibility into country of origin data.

According to Z2Data's analysis, organizations leveraging CoO information gain three key advantages:

Risk Identification: By mapping the true origins of components, companies can spot single points of failure before they cause disruptions. A capacitor might ship from a U.S. distributor, but if its manufacturing is concentrated in a single overseas facility, that's a vulnerability waiting to be exposed.

Strategic Diversification: SiliconExpert’s integration of CoO data demonstrates how origin data enables smarter sourcing. When engineers can instantly see alternative parts from different regions, they can design with built-in supply chain flexibility rather than scrambling during crises.

Compliance Assurance: As noted in Z2Data's risk profile analysis, origin data helps avoid regulatory pitfalls. Components from sanctioned regions or prohibited suppliers can derail projects even when technical specifications match perfectly.

Engineers Can’t Afford to Ignore This

Procurement teams focus on cost. Logistics teams worry about lead times. But engineers own the BOM — and thus the risk. If you’re not tracking CoO data today, then you’re flying blind into the next shortage, leaving your company exposed to tariffs and sanctions, and missing chances to dual-source intelligently

The lesson? Supply chain resilience starts with visibility. And that begins with knowing where your parts are born.

The Hidden Risks in Your Supply Chain

Most engineers treat their supply chain like a black box. Components arrive on time, meet spec, and integrate smoothly — until they don’t. The problem isn’t just whether a part is available, but where it comes from. Country of origin data isn’t about paperwork. It’s about understanding the invisible threads that tie your design to geopolitical shifts, trade policies, and even climate events.

Geopolitics as a Supply Chain Variable

Taiwan produces over 60% of the world’s semiconductors. China dominates rare earth metals. Malaysia is a hub for chip packaging. These concentrations create risk. When Russia invaded Ukraine, neon gas prices spiked 600% overnight because Ukraine supplied half the world’s supply. Companies tracking CoO data had already diversified, and those who didn’t faced months of delays.

The Myth of the Stable Supplier

A supplier might seem reliable today, but if 90% of their raw materials come from a single region, they’re one disaster away from collapse. For example, during the Thailand floods in 2011, hard drive prices doubled because Western Digital and Toshiba had concentrated production there. Firms with CoO visibility shifted orders early, and those who didn’t paid the premium.

Compliance Isn’t Optional

The U.S. recently added 31 Chinese firms to its Entity List. If your BOM includes their parts, you’re now non-compliant.

CoO data helps you:

● Avoid banned suppliers before they’re flagged

● Prove compliance for defense or medical contracts

● Audit subcontractors who might obscure origins

A Question of Responsibility

Procurement teams buy parts, but engineers choose them. If your design relies on a single-source component from a high-risk region, that’s an engineering decision — whether intentional or not. The best engineers don’t just design for function, they design for resilience. And that starts with knowing where your supply chain begins.

The Strategic Value of Origin Visibility

When you know where components originate, you stop being a passenger in your supply chain and start navigating it. Consider how global trade dynamics have shifted in the past decade. Tariffs appear overnight. Alliances realign. Manufacturing hubs rise and fall. Without origin visibility, these changes blindside you. With it, you can pivot before competitors recognize the threat. A capacitor shortage in Taiwan doesn’t become your crisis when your dashboard shows alternative sources in Germany already qualified and waiting.

This visibility also changes procurement from a cost game to a strategy exercise. The cheapest supplier often carries hidden risks—whether through concentrated regional dependence or opaque subcontracting. When a major automaker recently discovered its “Malaysian” chips were actually repackaged Chinese components subject to U.S. restrictions, the resulting factory stoppages cost millions. Those with full origin tracing avoided this trap.

For engineers, this data transforms design decisions. That specialized connector from a single-source supplier? Now you see it’s manufactured in a flood-prone region. The alternative costs 15% more but comes from three geographies. Suddenly, the value proposition shifts from pure technical specs to total system reliability.

The most advanced firms now treat origin data like a material property, just as critical as voltage ratings or temperature tolerances. They design supply chain resilience into products from the first schematic, not as an afterthought when shortages hit. This is the next frontier of engineering rigor: systems that work not just on the bench, but in the real world of trade wars, climate disruptions, and political upheaval.

Operationalizing Origin Data in Engineering Workflows

Knowing the value of country-of-origin data is one thing. Making it actionable within your design and procurement processes is another. The gap between awareness and implementation is where most organizations stumble.

The first step is integration. Origin data must flow seamlessly into the tools engineers already use - component libraries, PLM systems, and sourcing platforms. Leading enterprises now embed this information directly in their parts databases, tagging each component with its manufacturing geography just as they would with RoHS status or lifecycle stage. When an engineer selects a microcontroller, they immediately see technical specifications and supply chain risk profiles.

This integration enables smarter decision-making at critical junctures. During design reviews, teams can evaluate components not just for functionality but for geopolitical exposure. In procurement discussions, alternate parts can be pre-qualified based on regional diversification rather than scrambling during shortages. The most forward-looking companies are taking this further by establishing automated alerts that flag when a preferred part's origin shifts to a high-risk region.

The true power emerges when this data connects across departments. Engineering's component choices inform procurement's negotiation strategy. Manufacturing's capacity planning considers supply chain volatility. Quality teams track regional performance trends. This cross-functional visibility turns raw data into organizational resilience.

Building a Resilient Sourcing Strategy

The most sophisticated engineering teams now treat supply chain design with the same rigor as circuit design — because a technically perfect component is worthless if it can't be reliably sourced. This mindset shift requires moving beyond reactive measures and establishing proactive sourcing strategies anchored in origin intelligence.

Diversification emerges as the cornerstone principle, but not in the simplistic sense of merely having multiple vendors. True resilience comes from strategic geographic distribution across regions with complementary risk profiles. A power management IC sourced from factories in Taiwan, Germany, and Texas presents fundamentally different risk characteristics than one available from three different suppliers all clustered in Shenzhen. The difference lies in understanding not just supplier count, but supply chain topology.

Leading organizations are developing dynamic sourcing frameworks that automatically adjust procurement strategies based on shifting risk landscapes. These systems monitor geopolitical developments, trade policy changes, and even climate patterns, then recalibrate preferred supplier rankings in real time. When tensions rise in the Taiwan Strait, the system might temporarily elevate European and North American alternatives while maintaining the Asian options as secondary sources.

This approach requires deep collaboration between engineering and procurement teams. Component selection criteria expand to include not just performance specifications and cost, but supply chain robustness scores. Approved vendor lists evolve into multidimensional matrices that balance technical requirements with geographic diversity. The result is a living ecosystem of sources that can flex with global conditions while maintaining product integrity.

The competitive advantage goes to those who implement these strategies systematically rather than reactively. Companies that built diversified supply chains before the chip shortage gained market share while others idled production lines. In the next crisis — whether geopolitical, environmental, or logistical — the winners will again be those who prepared by making origin intelligence an integral part of their engineering DNA.

The era of treating sourcing as someone else's problem is over. Tomorrow's most successful products will be those designed with supply chain resilience as a first principle, not an afterthought. This demands new skills from engineers and new collaboration models across organizations — but the payoff is products that survive and thrive in an increasingly volatile world.

And there’s no better partner to diversify your supply chain with than Microchip USA, the premier independent distributor of board level electronics. Whether you’re sourcing a specific part or are looking to drive cost savings and optimize your supply chain, we’re here to help. Contact us today!